Reading: Secondary Marketing Research

Tapping Existing Sources of Information

Before launching into costly primary research, it’s smart to review whether relevant information already exists. This is called secondary research—using data originally collected for another purpose. Secondary research can reveal gaps, provide context, or even fully answer a marketing problem without additional data collection.

Internal Data

Organizations often start with their own data: sales and marketing records, customer accounts, purchasing trends, website traffic, and past research reports. Many firms compile these into analytics dashboards to reveal customer behaviour, market trends, and opportunities.

Government and Nongovernmental Organization (NGO) Data

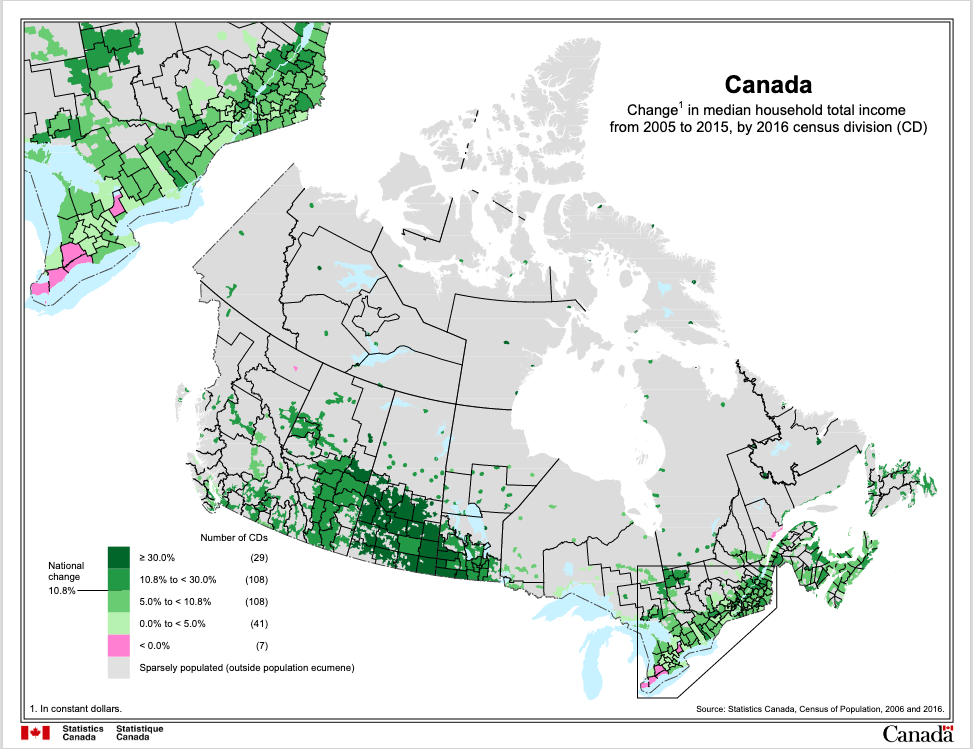

Public agencies and NGOs collect vast amounts of data, much of it free. For example, Statistics Canada publishes demographic, income, and labour force data useful for market segmentation. Provincial open data portals, such as Nova Scotia Government’s Open Data Portal has a range of data sources for the province including business and economy, government administration, nature and environment, and social services. offer datasets on business, environment, and social services. Globally, organizations like the World Trade Organization share economic and trade statistics.

You can view data for the median household total income on the Statistics Canada website[1].

Businesses frequently use this information for site selection, market sizing, and forecasting. For example, franchise chains often analyze traffic, demographics, and competitor density before approving new locations.

Industry Associations, Professional Journals, and Media

Professional associations and trade groups publish industry data, reports, and forecasts. Trade journals, academic research, and industry-specific media are also rich sources of insight. Following the right publications keeps marketers updated on customer trends, market shifts, and emerging challenges.

Professional associations and trade groups publish industry data, reports, and forecasts. Trade journals, academic research, and industry-specific media are also rich sources of insight. Following the right publications keeps marketers updated on customer trends, market shifts, and emerging challenges.

Commercial Marketing Research Data

A

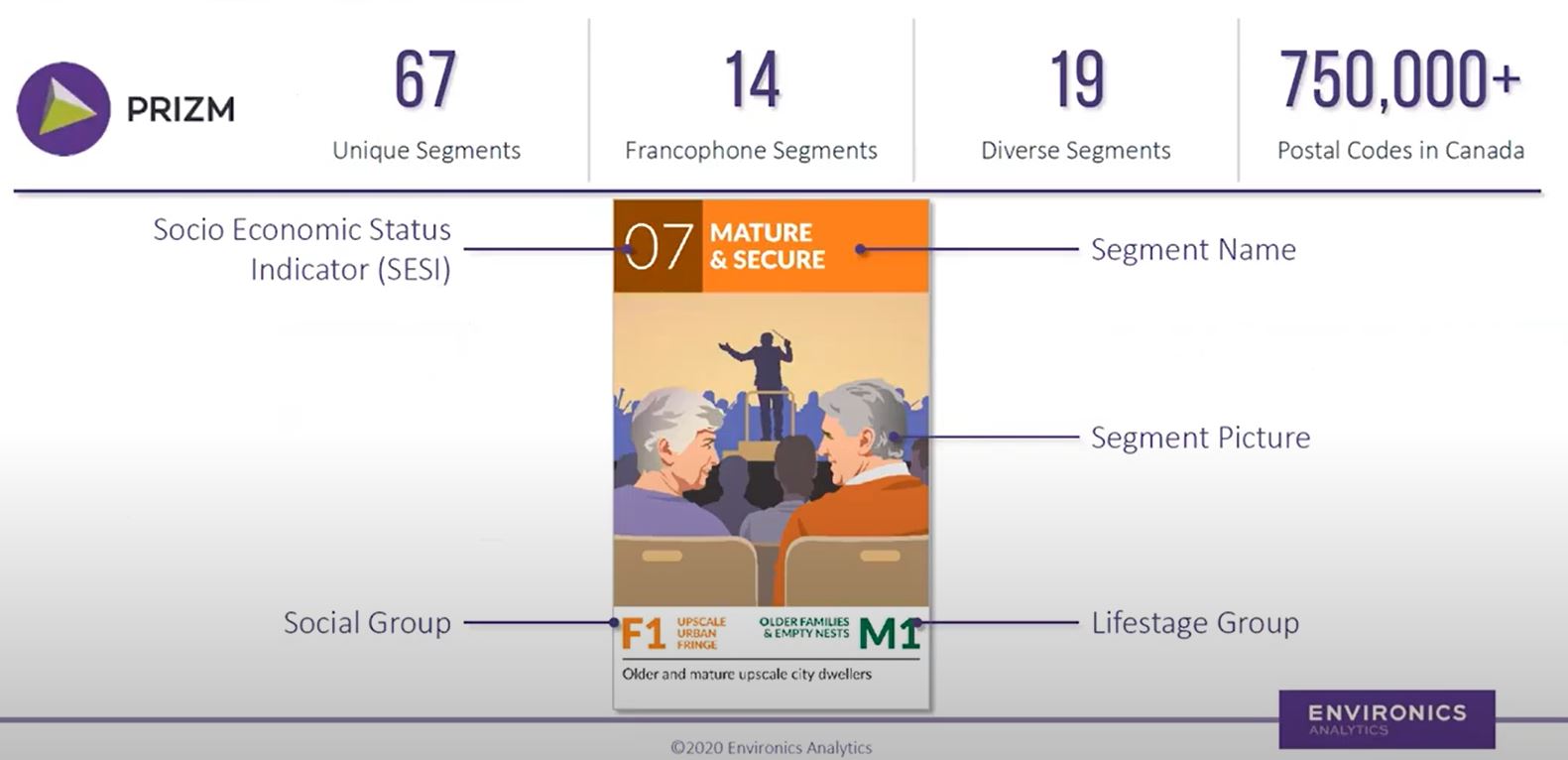

Companies like Nielsen and Environics Analytics sell syndicated research that provides lifestyle, demographic, and behavioural insights. For example, PRIZM, Canada’s leading segmentation system, groups the population into 67 lifestyle clusters, helping firms target everything from millennial urbanites to aging rural households. Click the link and enter a postal code to see sample PRIZM profiles, including demographic, behavioural, financial, health, and psychographic insights.[2]

Gain a fresh perspective on Canada’s distinct markets and communities

- 67 PRIZM segments reflect the evolution of Canada’s lifestyles and increasing cultural diversity including 14 francophone segments and 19 segments with high immigrant populations.

- Segments capture social currents including the growing prominence of millennials, an increasing senior population, and the rise in multigenerational households.

- “Urban Fringe” classification highlights once-suburban areas that are now much more urban as a result of intensification.

Environics has helped organizations like Credit Unions Atlantic Canada analyze customer segments and identify growth opportunities through interactive dashboards. [3]

Search Engine Results

inally, search engines provide a quick way to surface both free and commercial data sources. Even if you end up relying on paid research, scanning the web helps ensure you’ve covered available options.

Analyzing Secondary Data

Once collected, secondary sources should be reviewed for insights relevant to the problem. Findings may include:

-

Market size and trends

-

Demographic breakdowns

-

Consumer behaviours

-

Competitive benchmarks

Summarizing insights makes it easier to design any follow-up primary research.

Advantages and Disadvantages of Secondary Research

Advantages

-

Much cheaper and faster than primary research

-

Broad coverage (demographics, industries, competitors, etc.)

-

Increasingly accessible thanks to online portals and analytics platforms

Disadvantages

-

May be outdated

-

Collected for other purposes, so it may not fully align with your specific problem

Despite these drawbacks, reviewing secondary data is standard practice before investing in new data collection.

Creation note: This content was updated with the assistance of ChatGPT, a language model developed by OpenAI, and was subsequently reviewed and edited by the author for clarity and accuracy.

- Statistics Canada. (2017). Canada – Change in median household total income from 2005 to 2015, by 2016 census division. https://www12.statcan.gc.ca/census-recensement/2016/geo/map-carte/ref/thematic-thematiques/inc-rev/map-eng.cfm?TYPE=2 ↵

- Environics’ PRIZM (n.d) See Canada Through a Whole New PRIZM® With Powerful Consumer Insights https://prizm.environicsanalytics.com/#explore ↵

- Environics Analytics (n.d) Credit Unions Atlantic Canada https://environicsanalytics.com/en-ca/resources/case-studies/case-studies-details/credit-unions-atlantic-canada ↵